Introduction to Fintech and Biometrics

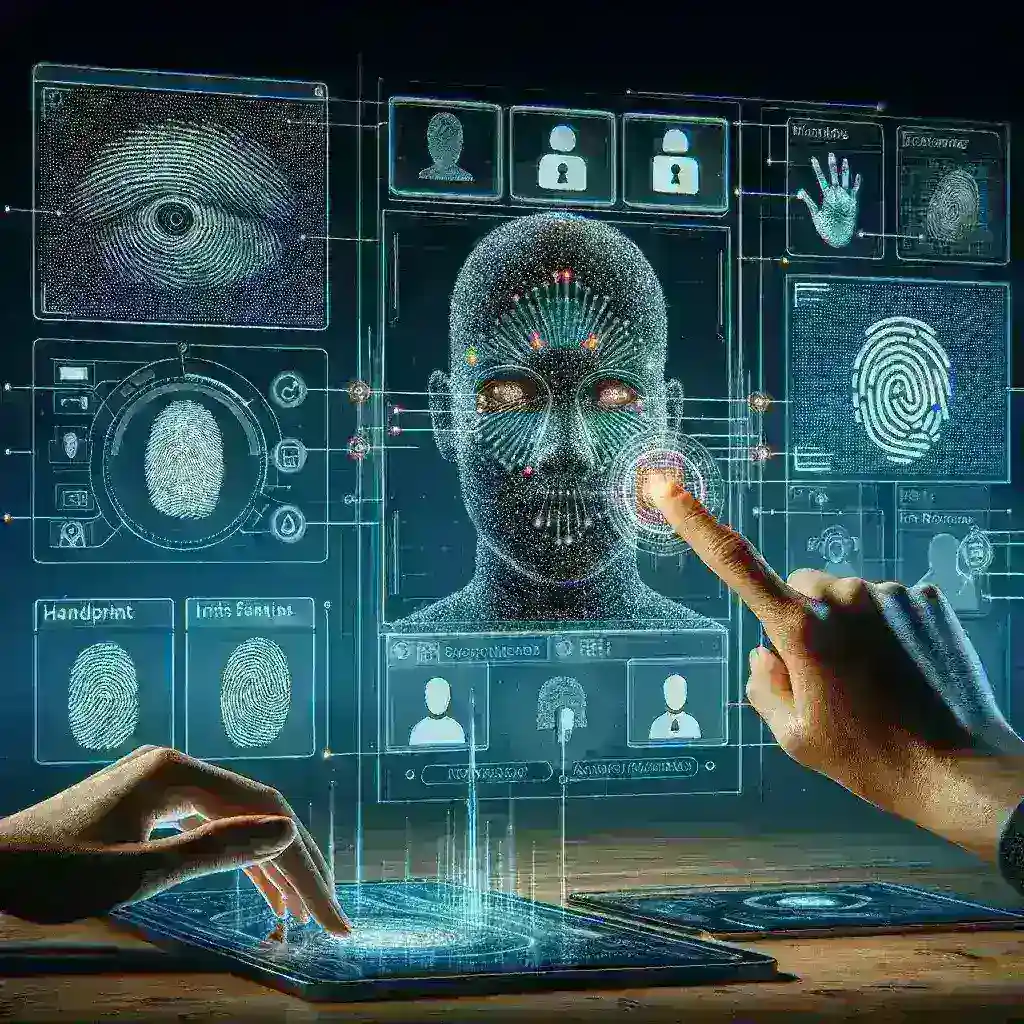

The world of finance is undergoing a revolutionary transformation, driven by technology that simplifies, secures, and enhances user experience. Among these advancements, fintech platforms utilizing biometric identification are leading the charge. These platforms leverage unique biological traits such as fingerprints, facial recognition, and iris scans to verify identity, offering a blend of convenience and security.

Understanding Fintech Platforms

Fintech, a portmanteau of ‘financial technology,’ refers to the integration of technology into offerings by financial services companies to improve their use of financial services. The emergence of fintech has democratized access to financial services, enabling users to engage with their finances in a more streamlined manner.

The Role of Biometrics in Fintech

Biometric identification enhances security protocols within fintech platforms. By employing this technology, companies can prevent fraud, identity theft, and unauthorized access. Here’s how it works:

- Fingerprint Scanning: A widely adopted method, fingerprint scanning is quick and uniquely identifies individuals.

- Facial Recognition: Utilizing advanced algorithms, this method verifies identity by analyzing facial features.

- Iris Recognition: Highly secure, iris recognition technology scans the unique patterns found in the colored part of the eye.

Benefits of Biometric Identification in Fintech

1. Enhanced Security

Security is paramount in financial transactions. Biometric systems provide a higher level of assurance compared to traditional passwords. For instance, while passwords can be forgotten or hacked, biometric traits are unique and cannot be duplicated.

2. Improved User Experience

Users appreciate convenience. With biometric identification, users can access their financial data instantaneously without the need to remember complex passwords. This seamless access helps in fostering customer loyalty.

3. Reduced Fraud

The implementation of biometric verification significantly reduces the risk of fraudulent activities. According to a report from Biometric Research Group, biometric systems can reduce identity fraud by up to 99%.

Challenges and Considerations

1. Privacy Concerns

Despite the benefits, the use of biometric data raises privacy concerns. Users must understand how their data is stored and utilized. Transparency in data management is critical for building consumer trust.

2. High Implementation Costs

Integrating biometric systems can be expensive for fintech companies. This includes the cost of technology, infrastructure, and ongoing maintenance. Smaller companies may find it challenging to adopt such systems.

3. Technological Limitations

While biometric systems are highly secure, they are not infallible. Issues such as false positives or negatives can occur, leading to potential access problems for legitimate users.

The Future of Fintech and Biometric Identification

As technology advances, the future of fintech platforms with biometric identification looks promising. Innovations such as AI-driven biometric systems will enhance security measures further. Moreover, as digital transactions continue to grow, the need for robust identification methods will become increasingly essential.

Predictions for 2025 and Beyond

- Increased Adoption: More fintech companies are expected to adopt biometric verification as a standard practice.

- Enhanced User Interfaces: User interfaces will likely become more intuitive, making biometric access even more accessible.

- Regulatory Developments: As usage increases, expect more regulations surrounding the management of biometric data.

Conclusion

Fintech platforms with digital identification via biometrics represent a significant shift in how financial services are delivered and secured. While challenges remain, the benefits of enhanced security and improved user experience are driving the evolution of this sector. As we look towards the future, adopting such technologies will be vital for both convenience and security in the rapidly changing financial landscape.

Deixe um comentário